Rythu Runa Mafi 3rd List for TS Crop Loan Waiver 2024 District Wise: The Telangana State Government has once again extended a helping hand to its farmers through the Rythu Runa Mafi Scheme. The government has now released the 3rd list under the scheme, which is aimed at waiving off outstanding loans of farmers across the state. If you’re a farmer in Telangana and have applied for this scheme, you can now check the beneficiary list on the official website. This article will walk you through the details of the Rythu Runa Mafi 3rd List, the scheme’s benefits, eligibility criteria, and how you can check your status online.

What is Telangana Rythu Runa Mafi 2024?

The Telangana Rythu Runa Mafi Scheme is a crop loan waiver initiative introduced by the Telangana State Government. It was designed to alleviate the financial burdens of farmers by waiving off their outstanding agricultural loans. The scheme is being implemented in multiple phases, and after the success of the first two phases, the government is all set to roll out the third phase on August 15, 2024.

Under this phase, the government will waive loans of up to INR 2 lakh for eligible farmers. This initiative not only helps farmers by reducing their financial stress but also enables them to focus more on their farming activities without worrying about loan repayments.

Overview of Rythu Runa Mafi 3rd List

- Scheme Name: Rythu Runa Mafi 3rd List

- Launched By: Telangana State Government

- Objective: To waive off outstanding agricultural loans

- Beneficiaries: Farmers of Telangana State

- Loan Waiver Amount: Up to INR 2 lakh

- Launch Date of 3rd Phase: 15th August 2024

- Mode of Transfer: Direct Benefit Transfer (DBT)

- Official Website: CLW Telangana Portal

Detailed Explanation of the Scheme

The Rythu Runa Mafi Scheme was launched with the aim of providing financial relief to the farmers of Telangana. Agriculture is the backbone of Telangana’s economy, and the state government recognizes the challenges faced by farmers, particularly those related to loan repayments. The scheme is a step towards empowering farmers by lifting the burden of loans, allowing them to lead more stable and secure lives.

The first phase of the scheme was launched on July 18, 2024, during which the government released INR 6034.97 crore to waive off loans up to INR 1 lakh for over 11 lakh farmers. The second phase followed on July 30, 2024, with the waiver of loans between INR 1 lakh to INR 1.5 lakh, benefiting more than 6 lakh farmers. Now, the third phase is set to provide even more substantial relief by waiving loans up to INR 2 lakh.

Eligibility Criteria for Rythu Runa Mafi 3rd List

To benefit from the Rythu Runa Mafi Scheme, farmers must meet the following eligibility criteria:

- Permanent Resident: The applicant must be a permanent resident of Telangana State.

- Farmer by Profession: The applicant must be actively engaged in farming.

- Loan Amount: Only loans of up to INR 2 lakh will be waived under this scheme.

- Loan Period: The loan must have been taken between December 12, 2018, and December 13, 2023.

- Loan Type: The loan must be a short-term agricultural loan.

Benefits of the Rythu Runa Mafi 3rd List

The Rythu Runa Mafi Scheme offers several benefits to the farmers of Telangana:

- Financial Relief: The scheme provides significant financial relief by waiving off loans of up to INR 2 lakh.

- Focus on Farming: Farmers can focus more on improving their agricultural practices without the constant worry of loan repayments.

- Improved Living Standards: By reducing the financial burden, the scheme helps in uplifting the living standards of financially unstable farmers.

- Increased Agricultural Productivity: With reduced debt stress, farmers can invest more time and resources into enhancing their productivity.

- Enhanced Social Status: The scheme aims to improve the social status of farmers by ensuring they are not overwhelmed by debt.

How to Check the Rythu Runa Mafi 3rd List Online

If you have applied for the Rythu Runa Mafi 2024 scheme, checking the beneficiary list is a straightforward process:

- Visit the Official Website: Go to the official CLW Telangana Portal.

- Login: On the homepage, click on the ‘Login’ option. Enter your username and password.

- Check DBT Status: After logging in, select the option to check DBT status.

- Enter Details: Enter your bank account number, bank name, and other required details.

- Submit: Review the details and click ‘Submit’ to view your status.

Rythu Runa Mafi 3rd List District-Wise

The Telangana State Government has released the Rythu Runa Mafi 3rd List district-wise. Here are some of the districts included:

- Adilabad

- Bhadradri Kothagudem

- Hanumakonda

- Hyderabad

- Jagtial

- Jangoan

- Karimnagar

- Khammam

- Mahabubabad

- Mahabubnagar

- Nalgonda

- Nizamabad

- Warangal

- And many more…

Farmers can check the list specific to their district on the official website.

Checking Rythu Runa Mafi 3rd Payment Offline

For those who prefer to check their status offline, the process is just as simple:

- Visit the Nearest Bank Branch: Go to your nearest bank branch.

- Consult with the Bank Official: Speak to the concerned official and provide the necessary details.

- Check Status: The official will help you check your Rythu Runa Mafi status.

Required Documents for the Scheme

To avail of the benefits of the Rythu Runa Mafi Scheme, you need the following documents:

- Aadhar Card

- Email ID

- Mobile Number

- Electricity Bill

- Address Proof

- PAN Card

Rythu Runa Mafi Installment Dates

The Rythu Runa Mafi scheme has been rolled out in phases, with specific installment dates:

- 1st Installment: 18th July 2024

- 2nd Installment: 30th July 2024

- 3rd Installment: 15th August 2024

Farmers can check the status of these installments on the PFMS Portalas explained below.

How to Check Rythu Runa Mafi 3rd Installment Status on PFMS Portal

Also Read: Rythu Runa Mafi 2nd List for Ts Crop Loan Waiver 2024 Online District Wise PDF

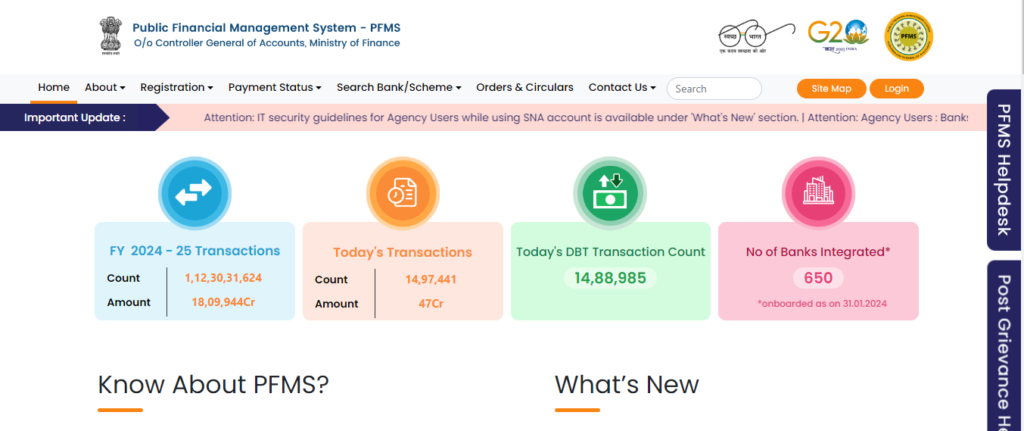

If you’ve applied for the Rythu Runa Mafi Scheme and want to check the status of your third installment, you can do so easily through the PFMS (Public Financial Management System) Portal. Follow these simple steps to verify your installment status:

Step 1:

Visit the official PFMS website. Ensure that you are on the correct and official portal to avoid any misinformation.

Step 2:

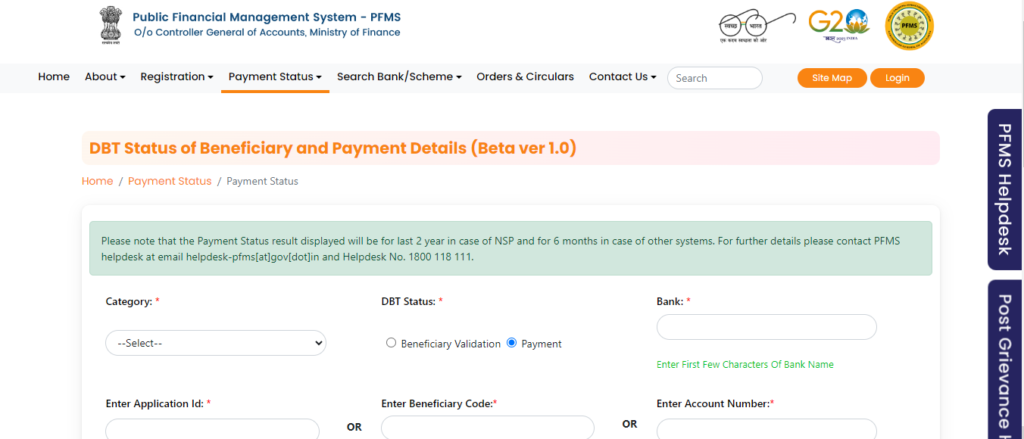

Once you’re on the homepage, locate and click on the option labeled “Check DBT (Direct Benefit Transfer) Status.” This option will direct you to the section where you can check the status of your installment.

Step 3:

You will be prompted to enter several details to verify your identity and application. These details include:

- The category under which you fall

- Your Bank Account Number

- The name of your Bank

- Your Beneficiary Code or Application ID

Ensure that all the details are accurate to avoid any errors in retrieving your status.

Step 4:

After entering all the required information, take a moment to review everything to ensure its accuracy. Once you’re sure that all details are correct, click on the “Submit” button to complete the process.

By following these steps, you will be able to see the current status of your third installment under the Rythu Runa Mafi Scheme on the PFMS Portal.

How to Log in to the Rythu Runa Mafi 3rd List

If you have already applied for the Rythu Runa Mafi Scheme and need to access your account, you can easily log in through the official website. Follow the steps below to complete your login process:

Step 1:

Start by visiting the official website dedicated to the Rythu Runa Mafi Scheme. Ensure that you are accessing the correct and official portal (official Rythu Runa website.)to avoid any potential security risks.

Step 2:

Once you are on the homepage, look for the “Login” option. This option is usually visible on the main menu or prominently displayed on the homepage. Click on this option to proceed.

Step 3:

You will be redirected to a new page where you will need to enter your login credentials. Carefully type in your Username and Password in the respective fields. Ensure that there are no mistakes in entering your details, as incorrect information could prevent you from accessing your account.

Also Read: Telangana Rythu Runa Mafi Status Check Online | Telangana Crop Loan status

Step 4:

After entering your username and password, take a moment to review the details you’ve inputted. Once you’re confident that everything is accurate, click on the “Login” button to complete the process.

By following these steps, you will successfully log into your account on the Rythu Runa Mafi 3rd List portal, where you can access all relevant information and updates regarding your application.

Frequently Asked Questions (FAQs)

1. Which state launched the Rythu Runa Mafi 3rd List?

- The Rythu Runa Mafi 3rd List was launched by the Telangana State Government.

2. When will the Rythu Runa Mafi 3rd List be launched?

- The third phase of the Rythu Runa Mafi 2024 will be launched on 15th August 2024.

3. How much loan will be waived under the Rythu Runa Mafi 3rd List?

- The government will waive loans of up to INR 2 lakh under the third phase of the Rythu Runa Mafi scheme.

4. Who is eligible for the Rythu Runa Mafi Scheme?

- Permanent residents of Telangana who are engaged in farming and have taken a short-term loan between December 12, 2018, and December 13, 2023, are eligible.

5. How can I check my name in the Rythu Runa Mafi 3rd List?

- You can check your name by visiting the official CLW Telangana Portal, logging in, and checking the DBT status.

6. What documents are required to apply for the Rythu Runa Mafi Scheme?

- Required documents include an Aadhar Card, Email ID, Mobile Number, Electricity Bill, Address Proof, and PAN Card.

7. Can I check the Rythu Runa Mafi status offline?

- Yes, you can check your status by visiting your nearest bank branch and consulting with the concerned official.

8. How many farmers will benefit from the 3rd phase of the Rythu Runa Mafi?

- Over 5 lakh farmers of Telangana State are expected to benefit from the third phase of the scheme.

9. What is the official website to check the Rythu Runa Mafi List?

- The official website to check the list is the CLW Telangana Portal.

10. What happens if I don’t find my name in the Rythu Runa Mafi List?

- If your name is not on the list, you may not be eligible, or there could be an issue with your application. It’s advisable to consult with local authorities or visit the nearest bank branch for assistance.

Detailed Overview Of The Scheme

The Rythu Runa Mafi Scheme is a significant initiative launched by the Government of Telangana to provide financial relief to farmers in the state by waiving their outstanding loans. This scheme is particularly important in the context of the agricultural sector, where many farmers have been burdened with loans that they are unable to repay due to various challenges such as poor crop yields, unpredictable weather conditions, and fluctuating market prices. By addressing these financial burdens, the scheme aims to improve the livelihoods of farmers and support sustainable agricultural practices in Telangana.

Background and Objectives

The Rythu Runa Mafi Scheme was introduced to alleviate the financial distress of farmers who have been struggling to repay their crop loans. The primary objective of the scheme is to waive off the outstanding loans of up to INR 2 lakh for eligible farmers. This loan waiver is intended to provide much-needed relief to those who have been unable to pay back their debts, allowing them to focus on farming activities without the constant pressure of loan repayments.

The scheme is part of a broader effort by the Telangana government to support the agricultural community and ensure that farmers can continue to contribute to the state’s economy. By reducing the debt burden, the government hopes to prevent farmer suicides, promote agricultural productivity, and enhance the overall well-being of rural communities.

Implementation and Phases

The Rythu Runa Mafi Scheme is being implemented in multiple phases to ensure that all eligible farmers benefit from the initiative. The first phase of the scheme was launched on July 18, 2024, during which the government released INR 6034.97 crore to waive loans of up to INR 1 lakh for more than 11 lakh farmers. The second phase followed on July 30, 2024, with INR 6190.01 crore allocated to waive loans between INR 1 lakh and INR 1.5 lakh for over 6 lakh farmers.

The third phase, which commenced on August 15, 2024, is focused on waiving loans up to INR 2 lakh. This phase is expected to benefit an additional 5 lakh farmers across the state. The phased approach allows the government to systematically address the needs of farmers and ensure that the benefits reach those who are most in need.

Eligibility Criteria

To qualify for the Rythu Runa Mafi Scheme, farmers must meet certain eligibility criteria. Applicants must be permanent residents of Telangana and actively engaged in farming. The loans in question must have been taken between December 12, 2018, and December 13, 2023, and must be short-term agricultural loans. Loans taken outside of this period or loans that have already been cleared by the farmers will not be eligible for the waiver.

Benefits and Impact

The Rythu Runa Mafi Scheme offers several benefits to the farming community. By waiving loans of up to INR 2 lakh, the scheme provides immediate financial relief to farmers, allowing them to redirect their resources towards improving their farming practices. This, in turn, is expected to lead to increased agricultural productivity and income stability.

Furthermore, the scheme aims to uplift the social and economic status of farmers by reducing the incidence of debt-related distress. By alleviating the pressure of loan repayments, farmers can focus on cultivating their land and contributing to the state’s food security.

In conclusion, the Rythu Runa Mafi Scheme is a critical initiative that addresses the financial challenges faced by farmers in Telangana. By providing substantial loan waivers, the scheme not only supports the agricultural sector but also enhances the overall well-being of rural communities, ensuring a more sustainable and prosperous future for the state’s farmers.

Conclusion

The Rythu Runa Mafi Scheme is a significant initiative by the Telangana State Government to support its farmers by waiving off their outstanding loans. The third phase of this scheme is set to provide immense relief to those struggling with debt, enabling them to focus more on their agricultural activities and improving their standard of living. By utilizing both online and offline methods, farmers can easily check their status and take advantage of this beneficial scheme.